According to analysts at CryptoQuant, a bullish setup is brewing, as Binance data suggests it may not be all doom and gloom as the scaremongers would have many assume.

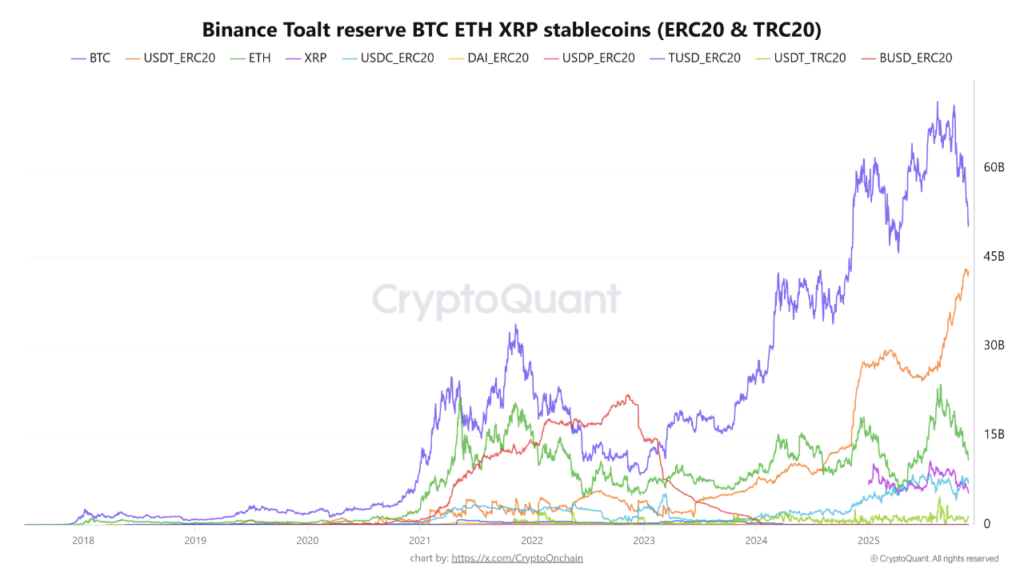

Despite the news, CryptoQuant reported that Binance’s Bitcoin (BTC) reserves have plummeted by 20 billion from a mid-August peak of 71 billion to around 51 billion as the broader crypto market has tanked. On the opposite end, stablecoin balances have been blowing up with both Tether (USDT) reserves – across TRC20 and ERC20 – going from 26 to over 50 billion, an all-time high.

Current reported Binance reserves for BTC, ETH, and XRP compared to stablecoins on ERC20 / TRC30. Source: CryptoQuant

XRP’s reserves have dropped by around a million dollars, and Ethereum (ETH) ‘s reserves are close to being cut in half overall, moving from over 20 billion down to under 11 billion – another massive outflow that has traditionally been read as a long-term bullish signal, showing investor interest in cold storage and decline of the short-to-medium term selling pressure.

Binance data suggests brace for a hefty leg up

Analysts have labelled the falling coin + rising stablecoin a rare combo, indicating that traders have been making profits at the top and now stand ready with big “dry powder.

“This volume of stablecoins sitting on the exchange acts as a coiled spring, which, upon price correction or macroeconomic normalization, would provide ample fuel for another parabolic move,” one analyst wrote on CryptoQuant. “The market is practising armed patience.”

It’s a plausible theory because spending power is at its highest point in history, with reserves bolstered by some $18 billion in new money in just a few short years. And when you factor in that investors are not withdrawing from fiat banks but instead shifting into stablecoins and leaving money on the likes of Coinbase, analysts see a bullish setup.

“The market is not losing liquidity; it’s reloading,” the same analyst wrote in a separate report on CryptoQuant, saying “Binance stablecoin reserves reaching an All-Time High implies smart money prep for a big move.”

For now, selling pressure from weak hands remains, but when that finally runs out of sellers, the $50 billion war chest is likely to drive the next big leg up, and it could be a move too fast for anyone not in position like the smart money.

Macro is coming down on the crypto market.

The last couple of weeks have been harsh on the crypto market, and analysts are now expecting some decent action.

With the fear and greed index finally leaving the extreme fear range for the first time since November 10, according to cryptopolitan, hope is still under attack by new problems, like some gatekeepers in TradFi pushing back.

The most recent battle is between JPMorgan and the S&P, after JPMorgan analysts in a November note warned that Strategy may see $2–$8 billion in outflows if it’s removed from MSCI indexes for having >50% of its assets in Bitcoin.

JPMorgan has been criticized by users who say it’s trying to profit from the situation by promoting the piece well after it was first published publicly to help tank Strategy’s stock, then front-run the market reaction by shorting it for a quick buck. It has prompted boycott calls from industry titans such as Max Kaiser and Grant Cardone.

As the industry wrestles with that development, the S&P, another heavy hitter from TradFi, has also struck a blow against Tether. Report: S&P Downgrades Tether’s USDT Credit Rating to ‘Weak’. The global credit rating agency S&P has downgraded the ‘Bitcoin Money’ meme project , which aims to mint USD-pegged stablecoins by collateralizing Bitcoin and gold.

Addressing the issue, Tether’s CEO Paolo Ardoino said he was proud and happy with how they were treated, and that such concerns stemmed from adversaries in the legacy system trying to stand in their way.